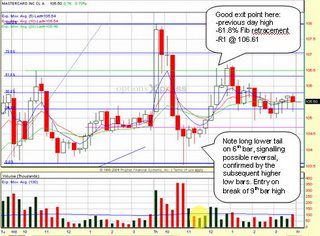

Day Trades That I Missed: X, MAN

X on 5 min setup. This is a higher risk setup than what Jamie has traded. Stock bounced off the low of Monday & last Fri. Note the strong volume when stock was picking up speed

MAN on 15 min setup. Self explanatory.

Simply Options Trading is where we discuss our EXCITING experience in the U.S. Stock Options Trading Market in simple terms, hence Simply Options Trading!

"Asked if there is room for gross margin improvement: Co notes thrilled with op margin for the quarter; notes exceptionally high driven by gross margins; says was influenced by the record revenue; 'do not get used to 18% operating margins'; says looking at 12% op margins for MarQ; says realize they are in a favorable cycle but would never forecast that number long term.. How much of gross margin sustainable: Guiding to 29.5% for MarQ; tgt gross margins in the 27-28% range; notes favorable commodity environment helped this quarter; expects different commodity environment and product mix to further push down margins; says product mix and favorable commodity environment were big drivers for margins this quarter.." - from briefing.comIMO, AAPL has more downside risk than upside, given its strong move up at the MacWorld event and all things positive is probably already factored into the soaring stock price. If you look back at the past 2 years, when AAPL continued its rise after Macworld, there is sell-off after earnings. But when there is sell-off after Macworld, stock price spike after earnings. Of course just looking at 2 years is not indicative of any solid patterns, but I note this interesting occurence. Next support for AAPL @ $93

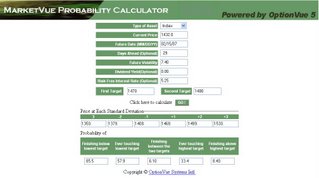

"Have you ever wondered why there is "85% probability" that the stock will be one side of a particular price point at a certain day?

First of all, the model assumes completely random direction every day from now until then.

And it uses the current Historical Volatility of the stock.

So if the stock has just had a big earnings jump and HV is high, then that tool will show you probabilities for very large distances.

If the stock has been very quiet lately and HV is low, the tool will be showing you a high probability that the stock won't move far.

However, if there is an upcoming news event like earnings, the stock actually will jump quite a lot, making the tool quite inaccurate.

Guess it helps to know how to take these things with a little salt ... being aware of how the stock's current Historical Volatility value compares to its likely future volatility will help you know if the tool is over or underestimating the future volatility of the stock."

"If the stock has been very quiet lately, and it's volatility could increase, perhaps due to news, the tool will be UNDERESTIMATING the distance the stock will move.

If the stock has just been jumping around, perhaps due to news events, and it can be expected to quieten down from here, the tool will be OVERESTIMATING the distance the stock will move.

The tool is unable to understand and predict the natural cycle of a stock's volatility changing with time."

The broker/dealer index has successfully broken out of the 244 resistance on Monday and today is at its all time high, with MACD and RSI both gaining strength. Check out stocks like GS, BSC, LM, LEH.

The broker/dealer index has successfully broken out of the 244 resistance on Monday and today is at its all time high, with MACD and RSI both gaining strength. Check out stocks like GS, BSC, LM, LEH. Nasdaq, which has been lagging S&P and DOW is now finally making its climb up on higher volume and higher lows. 50MA is a strong support, while 2470 is the level to watch for resistance.

Nasdaq, which has been lagging S&P and DOW is now finally making its climb up on higher volume and higher lows. 50MA is a strong support, while 2470 is the level to watch for resistance. OIH is still in its downward channel, having broken a strong support @ 130 on close 2 days ago. Next level of support @ 126. So where has the oil money gone to? Most probability used to light up the fire in tech and broker/dealer sector

OIH is still in its downward channel, having broken a strong support @ 130 on close 2 days ago. Next level of support @ 126. So where has the oil money gone to? Most probability used to light up the fire in tech and broker/dealer sector

"A new generation of Web sites has cropped up in recent months designed to help investors share ideas online with others who have similar investment styles, such as which Asian stocks or technology issues offer the best value. Unlike the Internet chat rooms that were popular in the late 1990s, which allowed any anonymous user to post opinions, the latest sites seek to maintain their credibility by rating participants. Users are assigned a score based largely on the performance of their stock picks and the accuracy of their forecasts..."

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld.

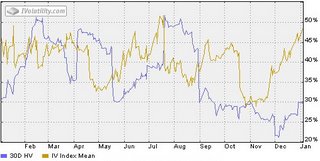

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld.  If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec.

If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec. The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue

The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline.

Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline. The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400

The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400