Lets Talk About APPLE

Ha, I am so used to keying in ticker AAPL that I have to correct the title of this post a few times to spell APPLE correctly. So much for tickers and abbreviations...I digress.

Apple loyalists would have known by now that the MacWorld Expo is kicking off next week. Most importantly, the keynote is scheduled next Tue, 9 Jan 07. Steve Job's keynote speech is a much anticipated one as new features and products of Apple are announced with much fanfare.

AAPL broke out of its downtrend on 29 Dec on news that Steve Jobs is cleared of wrong doing. It has now closed above 50MA and just shy of 20MA. RSI is also clearly on its way to recovery. Support @ $82, resistance @ $90. If history is to follow, then you may want to position some Jan call options.

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld.

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld.

In 2006, the market liked what they hear on the event and continued its buying spree after news was out. In 2005, the market sold into the news, possibly to lock in profits prior to another important announcement-earnings AMC on 12 Jan 05, a day after keynote speech. (note 2005 stock chart here is after stock split prices)

This time round in 2007, the timing schedule is pretty similar to 2006, with earnings coming out about 1 week later. But I've got no crystal ball to tell of its behaviour.

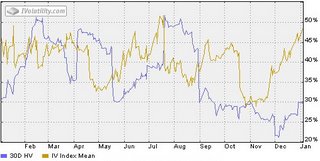

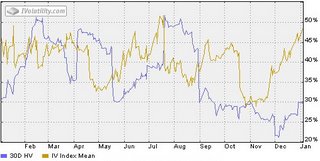

If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec.

If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec.

A few links for those interested in Apple's news & rumours:

- macrumorslive.com

I will definitely stay tune to this website to check out on Macworld keynote updates. It provides live coverage of Apple events and its updates are even faster than those on briefing.com. Interesting to see how the stock price reacts as new products are being launched.

-appleinsider

-thinksecret

Apple loyalists would have known by now that the MacWorld Expo is kicking off next week. Most importantly, the keynote is scheduled next Tue, 9 Jan 07. Steve Job's keynote speech is a much anticipated one as new features and products of Apple are announced with much fanfare.

AAPL broke out of its downtrend on 29 Dec on news that Steve Jobs is cleared of wrong doing. It has now closed above 50MA and just shy of 20MA. RSI is also clearly on its way to recovery. Support @ $82, resistance @ $90. If history is to follow, then you may want to position some Jan call options.

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld.

Looking back the past 2 years where MacWorld took place on 10 Jan 06 and 11 Jan 05, it is clear that market in general has positive expectation of this event, with stock climbing prior to MacWorld. In 2006, the market liked what they hear on the event and continued its buying spree after news was out. In 2005, the market sold into the news, possibly to lock in profits prior to another important announcement-earnings AMC on 12 Jan 05, a day after keynote speech. (note 2005 stock chart here is after stock split prices)

This time round in 2007, the timing schedule is pretty similar to 2006, with earnings coming out about 1 week later. But I've got no crystal ball to tell of its behaviour.

If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec.

If you are buying AAPL options, do note that its implied volatility is near 52 weeks high, which I attribute mainly to 3 culprits: The recent options scandal; anticipation of MacWorld event; earnings announcement on 17 Jan. HV on the other hand was at a 52 week low and started picking up in Dec.A few links for those interested in Apple's news & rumours:

- macrumorslive.com

I will definitely stay tune to this website to check out on Macworld keynote updates. It provides live coverage of Apple events and its updates are even faster than those on briefing.com. Interesting to see how the stock price reacts as new products are being launched.

-appleinsider

-thinksecret

0 Comments:

Post a Comment

<< Home