Taking A Look At The Indices

Having taken a long break, most traders should be back in action this week. The technicals in the last week or two has to be discounted given the light trading volume. The 1st week of the new year is typically bullish, with fresh funds looking for stocks to invest in. However, the technicals are looking a little weak, so lets see how the market plays out when it opens.

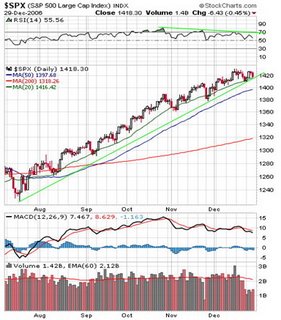

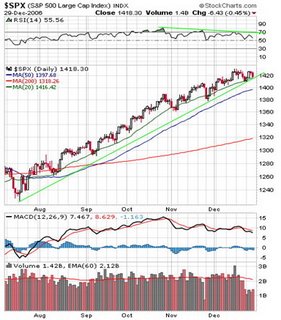

The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue

The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue

Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline.

Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline.

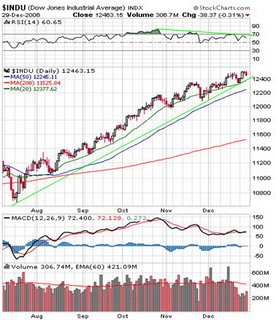

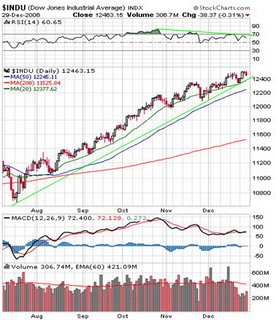

The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400

The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400

Week Ahead

This shortened trading week has got some key economic data and a few earnings announcements:

Wed: FOMC minutes

Thurs:

Notable earnings: STZ, MON

Fri: Unemployment rate

Notable earnings: GPN (also a big mover earnings stock)

The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue

The S&P 500 index is resting right on its upward trendline and 20MA, with MACD & RSI looking bearish. The key lies in whether it can bounce off this trendline for the climb to continue Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline.

Pretty much the same picture for Nasdaq, with it currently sandwiched between the 20MA and 50MA. Again, key in holding the 50MA and defending its trendline. The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400

The DOW is currently in mid-air, you can either see it as better off than S&P 500 and Nasdaq; or because the support is still a distance away, there is still room for more pullback. Look for support @ 12,400Week Ahead

This shortened trading week has got some key economic data and a few earnings announcements:

Wed: FOMC minutes

Thurs:

Notable earnings: STZ, MON

Fri: Unemployment rate

Notable earnings: GPN (also a big mover earnings stock)

0 Comments:

Post a Comment

<< Home