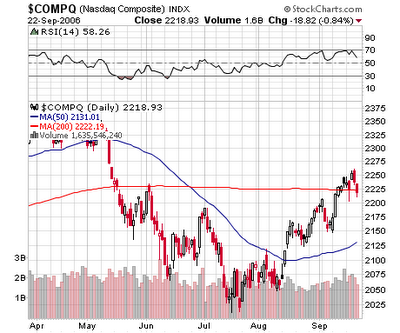

Nasdaq Technicals Telling A Story?

Am abit late this week in looking at the week ahead. Anyway, let's see what this new week is likely to shape up to be...

The Nasdaq, which closed last Fri below the 200MA is signalling a bearish story, albeit on a lower volume ahead of Rosh Hashanah Holiday. Look for it to test support @ 2200. Overall, I'm still leaning to the bearish camp early part of this week as the major indices were over extended prior to the sell-off last Thurs & the Nasdaq looking weak. But we may see a turn at the end of the week as we approach end of Q3, with some possible window dressing.

The coming week is filled with lots of economic data, especially important & can turn the tide is Consumer Confidence on 26/9 and Personal Income & Spending on 29/9. There are also some housing data on 25/9 & 27/9.

On the earnings front, watch for RIMM (28/9).

0 Comments:

Post a Comment

<< Home